In the rapidly evolving financial services industry, embracing digital transformation and IT modernization is crucial for organizations to stay competitive. Shifting critical workloads to a cloud environment enables financial services organizations to safeguard operations, enhance agility and efficiency, and meet evolving customer expectations. However, successful initiatives require collaboration with technology providers who possess specialized expertise in cloud storage.

One of the world’s largest financial institutions is embracing IT modernization with a cloud-first approach and has chosen Lightbits to power their cloud on AWS. Since the customer was already familiar with Lightbits for their on-premises datacenter, they chose us to architect a hybrid cloud scheme that facilitates the migration of high-performance, critical workloads to AWS. This customer’s objective was to support their internal application services on AWS without having to sacrifice the exceptional performance and low latency of their on-premises systems. In other words, they wanted to achieve a similar experience with Lightbits on the public cloud as they do on-premises. Cost-efficiency was also a key factor in their decision. If they couldn’t achieve high performance, and low latency, in a cost-efficient architecture on AWS then they would repatriate the workload back on-premises.

To meet these requirements, the financial institution evaluated various storage providers, including native cloud block storage solutions. Lightbits emerged as the optimal choice as a storage target on AWS due to its unmatched speed, flexibility, and efficiency. Lightbits, with its innovative software-defined, disaggregated, NVMe over TCP (NVMe/TCP) architecture, enables the shift of IO-intensive workloads to the cloud without compromising performance. Lightbits delivers consistent low latency, enterprise-grade features, high availability with multi-zone capability, and predictable and lower costs on AWS. It is purpose-built to deliver SAN capabilities for the public cloud era.

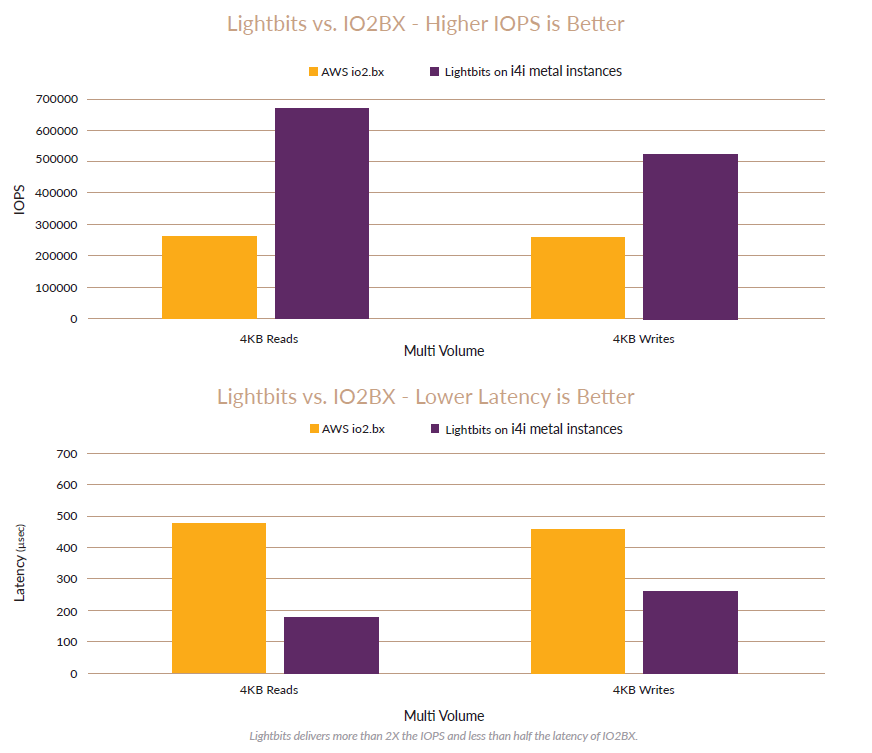

During the evaluation, Lightbits demonstrated remarkable results. With the most demanding 4KB random read/write workload, Lightbits achieved a 95-195% improvement in IOPS and up to a 300µs reduction in latency compared to the alternative solutions. Other tests using large block size and sequential workloads revealed a 155% throughput improvement and up to 150µs reduction in latency. Lightbits showcased its ability to deliver higher levels of IOPS while maintaining consistently low latency, making it an ideal solution for this financial services organization to migrate its workload to AWS.

Implementing Lightbits offers significant advantages for organizations migrating storage-intensive workloads to the cloud. It accelerates cloud migration, reduces total cost of ownership (TCO), increases return on investment (ROI), and minimizes operational risks associated with over- or under-provisioning storage resources. Leveraging Lightbits as a storage target on AWS instances can cut costs in half and deliver more than a 2X performance boost. When deployed on AWS reserved instances, the TCO is even lower, with potential storage cost reductions of 80% per 4TiB volume at 256K IOPS.

A TCO analysis conducted by Lightbits for this financial services customer revealed potential storage savings of $40.5 million over a three-year term, savings that could be achieved if managing 10PB on AWS GP3, with 10,000 volumes of 1TB and 16,000 IOPS each. If a customer is using IO2BX, the savings could be significantly greater. Furthermore, Lightbits software licenses are portable, which allows the same Lightbits software to run anywhere, standardizing the storage system across their on-premises datacenter and AWS.

By choosing Lightbits, organizations benefit from its software-defined, API-driven architecture, which simplifies operations and enhances efficiency, enabling organizations to move, shift, and allocate storage as needed. And because Lightbits improves data resiliency and durability, financial institutions can migrate their transactional and analytical workloads to AWS with confidence that their data is safe.

In conclusion, the financial services industry faces the challenge of adapting to cloud technologies. Embracing IT modernization and digital transformation through cloud infrastructure is essential to reduce risk and remain competitive. Lightbits’ next-gen data platform which is easy to consume on AWS empowers financial services organizations to achieve efficiency, flexibility, and agility on the cloud.

Additional resources: